Buying a Business

Acquisition Due Diligence Training and Support for DIYers

M&A Due Diligence:

DIY Training –

Staging –

Scopes –

Timing –

Outsourcing

There are many people pitching unnecessary, incomplete, defective, poorly timed, and/or overpriced services to uninformed searchers.

You don’t need to outsource everything or to unnecessarily waste tens of thousands of dollars or suffer excessive weeks waiting for due diligence service providers to complete their evaluations and then submit their reports.

It’s risky to be a do-it-yourselfer.

Unless you hedge your risk and increase your opportunities.

You can do that if you know when and how to be a DIYer.

If you do what this webpage recommends, your advisory team won’t have to charge you to gather the materials and information they need to perform their specialized services. We’ll assemble packages that meet their requirements, which will accompany your due diligence.

I’m Ted Leverette, The Original Business Buyer Advocate ®. I can help you.

If you’re reading this webpage, you’ve probably heard about Quality of Earnings evaluations and reports.

Some lenders require a professional third-party QofE report as a condition for financing business acquisitions.

QofE scammers?

I won’t, here, say scammers are within the horde of people touting their expertise for Quality of Earnings evaluations and reports. But I can show you how to avoid the worst of them and how to evaluate the best of them before you risk paying fees ranging from $5,000 to more than $30,000. (For each report.)

I’ll also show you how to materially reduce your risks and costs during due diligence, and then complete worthwhile deals sooner and with less aggravation.

Select From the Best — Avoid the Rest

I can help you identify, screen, evaluate, and negotiate with the various kinds of due diligence service providers. (Yes, it’s smart to shop and compare.)

Why learn from me?

Although trained and experienced in accounting and finance, I do not offer or perform accounting tasks, including Quality of Earnings reports. My job is to help you do what you can on your own.

I provide training, guidance, oversight, and second opinions.

You outsource only what is necessary or required.

I help you identify, evaluate, and select service providers.

Let’s begin with a 1-hour private Zoom.

I’ll answer your questions and convey tips for your immediate use.

And then, I can propose how I can further help you progress through due diligence, staging, scopes, timing, and/or outsourcing.

Email Ted J. Leverette, The Original Business Buyer Advocate ®. “Partner” On-Call Network, LLC

Marketplace Reality – It Takes Longer Than You Think

Searchers risk losing access to sellers or losing their money if they don’t understand, and know what to do about, the kinds of NDAs, LOIs, and searcher-disclosures and conditions/contingencies demanded by brokers and sellers.

Why? From a business AND legal view, your earliest agreements with brokers and sellers materially define what you can do and expect. During negotiations and otherwise.

Lots of activities must run concurrently to meet LOI and other deadlines.

- Due diligence service providers may need 4 to 8 weeks to evaluate businesses for sale and then submit their reports.

- Business brokers may say letters of intent should provide for no more than 90 days for for buyers to submit a binding purchase agreement.

- Lenders may take at least 30 days from the time you apply to when you get an approval, if you get an approval.

- Lawyers and accountants can take several weeks for them to do their work for you during due diligence, most of which they might complete before you submit a purchase agreement.

Rarely, in my experience, have buyers and sellers of small and midsize businesses completed worthwhile deals in less time than they thought it would take. It’s usually longer. Sometimes much longer.

Why? Team members stepping on each other’s toes, thanks to buyers and sellers not knowing how to manage their teams.

Avoid What’s Avoidable

The risk is unnecessarily paying for professional services that reveal problems that thwart deals. Brokers and sellers could make it easier for everyone by not offering their opportunities until they’ve gathered what they know buyers, lawyers, accountants, and lenders must see . . . and present it in more easily digestible formats.

Searchers/buyers could do their homework and assemble better teams, much earlier so they don’t waste everyone’s time asking for bits and pieces, and then continuing to do it.

Something to think about when you’re deciding who to hire, and when to deploy your advisors/experts, and how to draft timelines for letters of intent and definitive purchase agreements. Isn’t it?

Next, let’s see what you can control . . .

M&A Due Diligence:

DIY Training – Staging – Scopes – Timing – Outsourcing

I can help you do it. Outline below. Details here.

Staging due diligence and negotiations:

- Pre-LOI

- Post-LOI (before purchase agreement)

- Post-Purchase/Sale Agreement (paying attention to provisions/contingencies for escape without penalty)

- Proposing changes to the purchase agreement based on final stage due diligence.

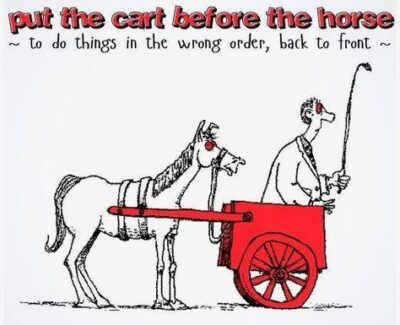

What’s your risk if you put the cart before the horse?

Email Ted J. Leverette, The Original Business Buyer Advocate ®. “Partner” On-Call Network, LLC

Not sure?

Watch this:

2-Minute Video Reveals What The Savviest Searchers Do

Preview my books:

120 Financial Lifelines for Small Businesses

How to Prepare Yourself and Find the Right Business to Buy

How to Buy the Right Business the Right Way—Dos, Don’ts & Profit Strategies

21st Century Entrepreneur Ideas for Kids and Aspirational Adults (Complimentary)

How to Get ALL the Money You Want For Your Business Without Stealing It (USA and Canadian versions.)